HOW TO CREATE AN EFFECTIVE PITCH?

There are very few cases in which it is enough for a Startup to show a list with metrics and outcomes to draw an investor´s attention . In most cases, even when things are going well and we can demonstrate an exponential growth and promising business model that delivers results, capturing the attention of an investment fund, an angel investor, an acceleration program , or even the press, requires an effective and well planned pitch.

A pitch, a term that may already be beaten so much that we hear it, involves much more than the words we speak for a demo day, an exhibition, while we present ourselves to someone else at a fair, or during an informal chat over coffee. A truly effective pitch can briefly sum up the problems we intend to solve, the solution found to this problem, the implementation of this solution, how to market it, and if we are seeking for funds, a plan of action for the money we are asking . But while some of these points may be absent and there is actually a unique structure that we use, there is an element that is fundamental and can not be missed under any circumstances; a good pitch should generate enthusiasm and willingness to learn more.

It is for this reason and to maximize the chances of success that even those who have a way with words and do not suffer when speaking in public, need to take the time to outline his pitch, and incorporate practice. Because no possibility exists-even if we are in a good day- to improvise something that works really well without at least a basic idea or a thread that we can continue.

But before we sit down to write is necessary to know in what to think about. That’s why we put together this little guide, which includes the most important elements we have to keep in mind when thinking about the words that, whenever we can, we will present in our project.

The foundation: a good story

One of the fundamental aspects of a pitch that generates interest is to have a story. One reason that led us to discover the problem which then we will delve.

A good story has several advantages. On the one hand allows us to explain through a metaphor or an analogy the problem we will talk about in such a way to simplify it for the audience. Secondly, a story allows the public to interact with us, understand us and know us better. Finally, you can prove passion for what we do, and true motivation for creating a great product.

No need to tell a true story . The important thing is that pulls together these requirements and is credible enough to generate a positive impact. An alternative, if we can not achieve this, is to appeal to exaggeration and humor, although sometimes can backfire if it is not applied with surgical precision and with great confidence.

PSP: Problem, Solution and Product

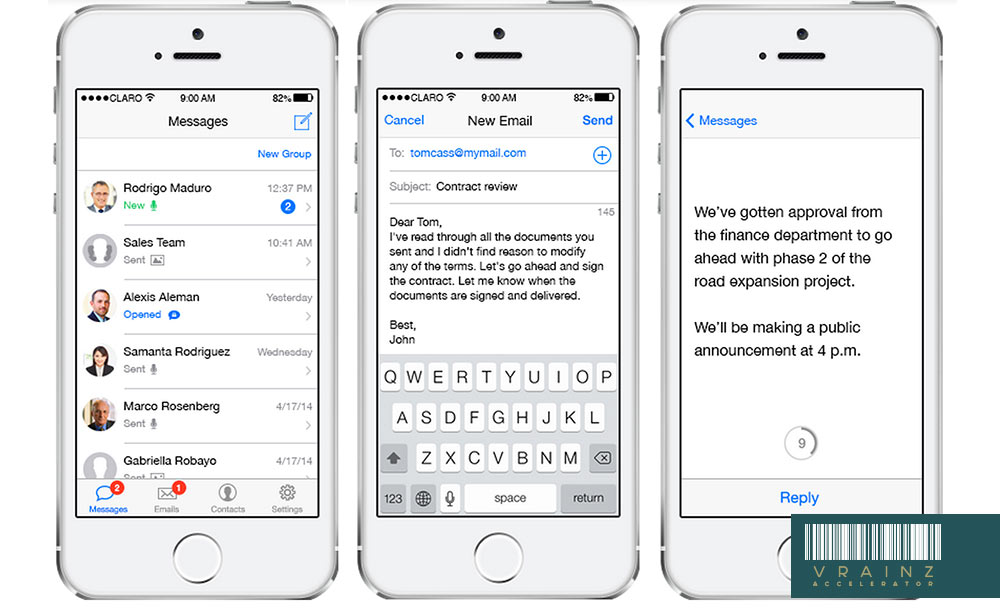

Once we have the attention of the audience, we move to the next point, which is to explain the problem that your product or service seeks to solve. It is essential, when the problem is detailed, to explain to whom it affects. That is, what will be our market, in what way, and to what extent is afflicted by it. Understanding the problem is the first step to understand the product, especially when it comes to complex markets or innovative solutions, so it is necessary to be clear and concise on this point.

The next step is to explain the solution. It is, in short, how we propose to solve the problem. At this point we can use an analogy, or a conceptual description of what we do and then delve into the product itself again.

It is essential to note that, unless we are talking about a product pitch, or that we have something completely different from anything seen, it is not necessary to cross it step by step, but to tell briefly what it is about, why it resolves the problem, and why it is vital to our target audience.

The business model

This aspect of the pitch is not essential in all cases, but it is important for companies with a certain journey, and when we present ourselves to any type of investor. It comes to explain what will be the business model through which the company will generate a turnover. It is prudent to explain why this model was chosen and, as far as possible, incorporate some projection to show that it will generate growth and is scalable.

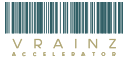

Metric and adoption

This is a point of the pitch that will vary depending on the stage in which we find our Startup. Anyway, it’s always good to show some traction, which can be observed in a large number of users, a lot of customers, or a certain revenue levels; or at least a great potential, which can be seen in the number of customers or users that showed interest in our product or service, or the results of a successful competitor in our own market. Whatever the case, we must show that our product or service, with appropriate funding, has the potential to become a real success.

The Team

This point, which is many times overlooked, it is of great importance for most investors, and is completely vital for incubation and acceleration´s programs. A good team is the foundation of a successful company, much more than the product which always suffer changes- or business model. A solid, experienced team, with different profiles and skills, a background to offer any kind of support and safety generates trust and interest in backing the project. Of course, not all Startups meet all these requirements. However, it is important to present what we have with the greatest enthusiasm possible, and showing that it is a suitable group capable of taking the company forward.

The Action Plan

This point is only necessary if we are looking for a particular investment, but it is important to show why need the money, and if we receive it, in which we will be investing.

This plan must be consistent with everything we have about the product, our market and our business model, although not necessary to enter into specifics. We just need to show that we know our business and we know what their needs are.

An attractive closure and a call to action

Finally, to close our pitch we need a consistent close to our history and to generate enthusiasm. It can be a high turnover figures or users, or just a future promise. Either way it should sound realistic. At the same time, it is necessary to convert the interest we’ve woken up in a concrete benefit, so it is important to include a call to action such as an invitation to contact us or directly to learn more about our company, so as to let us know which audience is willing to get in touch or interested .

It is important to remember that, at times, a pitch may include a round of questions, so it is good to select one point we want to highlight and strategically leave it out of our presentation, or mention without giving much detail, so as to guide the public to focus on that topic.

How we said at the beginning, there are several circumstances in which an entrepreneur needs to appeal to their pitch, so it is not advisable to fit a single format. After all, it is not possible to give a five-minute monologue for a coffee. But if it’s important to write a story, meet each of the points mentioned above, and to adapt to the circumstances in which we speak. In this way our speech will always be consistent, and will come out easily either to talk for twenty seconds without ever going into detail or give a lengthy presentation by focusing on each point of our company.

Writing a good pitch can be difficult and require some inspiration, therefore we have included some videos that can arouse enthusiasm and desire to sit and create your own:

Vizify

A correct pitch with a classical structure very well done.

Klash

This pitch uses the grotesque to draw attention in a manner consistent with your product and its potential market.

Rapt.fm

A pitch that uses a story to introduce your project and builds its identity from her.